Zimmer Biomet Holdings, a global medical technology leader, and Paragon 28, a leading medical device company focused exclusively on the foot and ankle orthopedic segment, announced they have entered into a definitive agreement for Zimmer Biomet to acquire all outstanding shares of common stock of Paragon 28 for an upfront payment of $13.00 per share in cash, corresponding to an equity value of approximately $1.1 billion and an enterprise value of approximately $1.2 billion. Paragon 28 shareholders will also receive a non-tradeable contingent value right (CVR) entitling the holder to receive up to $1.00 per share in cash if certain revenue milestones are achieved. The CVR will be payable in whole or in part if net sales exceed $346 million up to $361 million (with the CVR payments calculated linearly between $0.00 and $1.00 if net sales are between $346 million and $361 million) during Zimmer Biomet’s fiscal year 2026. The board of directors of each of Zimmer Biomet and Paragon 28 has unanimously approved the proposed transaction.

Related: Kaneka acquires EndoStream Medical

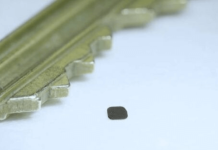

Established in 2010, Paragon 28 has an extensive suite of surgical offerings and product systems spanning all major foot and ankle segments, including fracture and trauma, deformity correction and joint replacement. Since its inception, Paragon 28 has been singularly focused on bringing to market innovative solutions to address areas of unmet need in the foot and ankle segment.

“This proposed transaction further diversifies Zimmer Biomet’s portfolio outside of core orthopedics and positions us well in one of the highest growth specialized segments in musculoskeletal care, while creating cross-selling opportunities in the rapidly growing ASC space,” said Ivan Tornos, President and Chief Executive Officer of Zimmer Biomet. “Paragon 28’s broad and innovative foot and ankle portfolio, robust product pipeline and dedicated and highly trained sales force, combined with Zimmer Biomet’s global reach and capabilities, will uniquely position us to address the unmet patient needs of this highly complex anatomy.”

“We are incredibly proud of the legacy we have built at Paragon 28 as an industry leader committed to continuously improving the outcomes and experiences of patients suffering from foot and ankle conditions,” said Albert DaCosta, Chairman and CEO of Paragon 28. “Joining Zimmer Biomet is an exciting new chapter for Paragon 28 and an incredible opportunity to advance our mission and continue to deliver groundbreaking solutions in the foot and ankle segment.”