European device company TRiCares has raised $50m in a Series D financing round to develop its transfemoral tricuspid heart valve replacement system, Topaz.

The company plans to use the funds to conduct an early feasibility study in the US and initiate a pivotal trial in Europe. Additionally, the investment will be used to develop more valve sizes for Topaz. The Series D funds were raised from a single, strategic unnamed investor.

Related: Kestra Medical raises $196m to support wearable cardioverter defibrillator

TRiCares has received an investigational device exemption (IDE) from the US Food and Drug Administration (FDA) to conduct an early feasibility study, due to start later this year. The company plans to enrol patients across eight sites in the US and Canada and start a pivotal trial for obtaining a CE mark for Topaz in Europe soon.

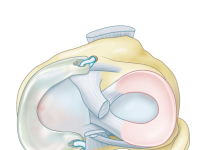

Valve replacement is done in patients with severe valvular heart disease. As blood flows around these valves it causes high stress, thereby, activating platelets and coagulation. TRiCares’s Topaz system is designed as a treatment for patients who require tricuspid valve repair but are not able to withstand open heart surgery or for whom the open surgery may be too risky.

GlobalData expects the transcatheter tricuspid valve replacement market to grow from being worth $10m last year to more than $2bn in 2033. The growth will be driven by the increased adoption of these devices and surgeons becoming more familiar with these procedures.

Multiple companies are developing tricuspid valves. In April, Abbott’s TriClip transcatheter edge-to-edge repair (TEER) system was cleared by the FDA to treat tricuspid regurgitation. In May, Meacor raised $15m in Series A financing to develop its Cryocinch system, a new minimally invasive treatment for mitral and tricuspid valve regurgitation.