Picard Medical, the company behind the SynCardia Total Artificial Heart (TAH), announced the pricing of a $17 million initial public offering (IPO).

The Tucson, Arizona–based company plans to offer 4.25 million shares of common stock priced at $4 apiece. That equals proceeds of $17 million before deducting underwriting discounts and offering expenses. Underwriters have a 30-day option to purchase up to an additional 637,500 shares as well.

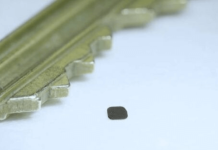

Related: Vaxxas raises $58.4M for needle-free vaccine delivery tech

Picard received approval for the listing of its shares on the NYSE. It expects them to begin trading on Aug. 29, under the ticker “PMI.”

The company plans to use the proceeds from the IPO to support market expansion via a joint venture established in China. It also plans to fund R&D activities, including those related to the Emperor next-generation TAH. The company designed the Emperor as a fully implantable, driverless version of the Syncardia TAH. It also plans to build out next-generation portable driver systems.

Other uses for proceeds include TAH system sales, marketing and distribution capabilities. The company expects funds to go toward the costs of additional inventory and an expanded base of drivers, as well as debt repayment.

This marks the latest medtech IPO as this route to going public appears to be making a comeback. Most recently, HeartFlow closed its IPO earlier this month, with AI-powered spine surgery company Carlsmed completing its IPO last month.

Wearable defibrillator maker Kestra Medical went public in March, not long after automated insulin pump maker Beta Bionics in January completed its $204 million IPO. Last year, heart valve company Anteris Technologies and neurotech company CeriBell completed IPOs. Additionally, medtech distribution giant Medline submitted a draft registration to the SEC related to a proposed IPO in December.