NeuroOne priced an underwritten registered public offering of common stock worth $8 million.

The Eden Prairie, Minnesota-based company priced 16 million shares of common stock at 50¢ apiece in the offering. It intends to sell all shares of common stock sold in the offering. The company also granted the underwriter a 45-day option to purchase up to an additional 2.4 million shares at the public offering price.

Related: SamanTree Medical closed a Series B extension, bringing the total financing round to $20m

NeuroOne expects to use the proceeds of $8 million (before discounts, commissions and offering expenses) for general working capital. It earmarked April 7, 2025, for the closing of the offering, subject to customary closing conditions.

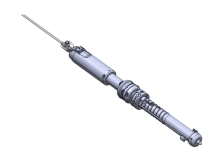

The latest capital infusion for NeuroOne follows recent big news on its portfolio. Last month, the company accelerated the anticipated timeline of the FDA submission for its nerve ablation tech. It now expects to submit its trigeminal nerve ablation system for FDA 510(k) clearance in May. It previously projected a submission by the end of June.

Trigeminal nerve ablation, a minimally invasive procedure, uses radiofrequency (RF) energy to destroy abnormal tissue. This, in turn, relieves severe, chronic pain in the face caused by trigeminal neuralgia. Using the company’s patented OneRF platform, NeuroOne designed its procedure to provide pain relief for this condition.

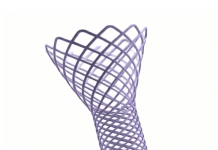

NeuroOne’s OneRF system previously picked up FDA 510(k) clearance in December 2023 for the creation of radiofrequency (RF) lesions in nervous tissue for functional neurosurgical procedures. This technology uses already-implanted sEEG electrodes to record brain activity and enable the ablation of nervous tissue. The company also has a distribution deal with Zimmer Biomet that covers the technology.