ImpediMed has received $15m in funding for five years from SWK Holdings, which is set to enhance its ability to grow and commercialise its offerings, particularly the SOZO Digital Health Platform.

The capital facility will provide ImpediMed with the financial flexibility needed to further its commercial strategy.

Armentum Partners served as the exclusive financial adviser for the transaction.

Related: Globus Medical to acquire Nevro for $250m to expand treatment options

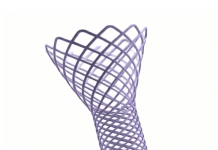

ImpediMed’s SOZO Digital Health Platform is claimed to be the only bioimpedance spectroscopy (BIS) technology cleared by the US Food and Drug Administration (FDA) for the clinical evaluation of breast cancer-related lymphoedema (BCRL).

The platform is “recognised” for its accuracy in lymphedema screening, now covered by US health payors for more than 258 million individuals. Its increasing clinical adoption and payor coverage signify a transformative shift in the management of lymphoedema, stated the company.

Leveraging BIS to detect early fluid changes, the platform allows for timely intervention before lymphoedema becomes chronic.

This early identification is crucial, as the condition is often challenging to detect before symptoms manifest.

A SOZO test can be conducted by any care team member, with immediate outcomes accessible at the point of care and through the MySOZO web-based portal. The outcomes can also be integrated into the patient’s electronic health record (EHR), streamlining documentation.

Using BIS, the L-Dex score offers a rapid and precise measurement of lymphoedema-related fluid changes, aiding in the consistent monitoring of lymphedema.

SWK Holdings is a company specialising in finance for the life sciences sector.

ImpediMed managing director and CEO Dr Parmjot Bains said: “SWK’s proven approach to supporting innovative healthcare companies makes them an ideal partner for us as we pursue our commercial growth strategy over the next five years.

“In conjunction with our existing cash reserves, this facility gives us the time and funding flexibility required to execute our business plan and fully capitalise on the BCRL opportunity.”