While heart devices and neurology dominate the funding landscape in 2025, it’s great to see other clinical specialties attracting investor attention and funding. From ophthalmology and diabetes care to surgical AI and vascular imaging, this week brought good news for a variety of startups and growing businesses.

Iantrek raises $42m to fuel US glaucoma treatment launch

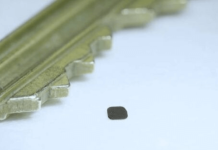

Eyecare specialist Iantrek has raised $42m to support the US launch of its allogeneic graft for treating glaucoma. Through its bio-interventional ophthalmic surgery (BIOS) platform, Iantrek’s AlloFlo Uveo targets the uveoscleral pathway.

The investment round was led by US Venture Partners (USVP) and brings Iantrek’s funding to date to around $85m. New investor aMoon, and existing investors including Visionary Ventures and Sectoral Asset Management, also participated.

CEO Adam Szaronos

Last week’s tracker: Heartflow, Fresenius, and more

Luna Diabetes raises $23.6m Series A for automated insulin patch pump

Luna Diabetes closed a $23.6 million Series A financing round to support its insulin delivery technology. Vensana Capital led the financing round for the San Diego-based company.

The Swiss Diabetes Venture Fund, Ascensia Diabetes Care, Winklevoss Capital and other prominent investors also participated. Funding supports the development of Luna, the company’s automated insulin delivery patch pump system.

CEO John Sjölund

Method AI raises $20m for image-guided surgery platform

Method AI announced it raised $20 million in Series A funding to support its novel surgical ultrasound platform. The company aims to resolve surgical visualisation challenges experienced by robotic surgeons.

A private family office led the funding round, while Cleveland Clinic and the JobsOhio Growth Capital Fund also participated. Funds support the continued development of the company’s surgical platform.

Co-Founder and CEO Doug Teany

Neurovalens brings in $8.1m for neurostimulation technology

Neurovalens closed an investment round worth approximately $8.1 million (£6 million) in proceeds. The Investment Fund for Northern Ireland (IFNI) led the financing round for the Belfast-based company.

Neurovalens develops the Modius neurostimulation products. Neurovalens designed the device to deliver non-invasive electrical stimulation. It stimulates key areas of the brain and nervous system without the need for surgically implanted electrodes.

CEO Jason McKeown

Moonrise Medical secures $500,000 investment from Ontario Centre of Innovation to advance vascular imaging technology

Moonrise Medical announced it has secured a $500,000 investment from the Ontario Centre of Innovation (OCI) through the Life Sciences Innovation Fund (LSIF).

This investment will accelerate the development and commercialization of Moonrise Medical’s innovative ultrasound system, designed to simplify and automate the diagnosis of peripheral artery disease (PAD).

CEO Adam Gold

Other news:

Edwards announces $500M accelerated share repurchase

Edwards Lifesciences announced that it executed an accelerated share repurchase agreement. Irvine, California-based Edwards triggered the agreement to repurchase $500 million of its common stock.

With this transaction, the company’s total repurchased shares reach more than $800 million in 2025. That adds to significant repurchases announced alongside the sale of the company’s Critical Care business to BD last year.

CEO Bernard J. Zovighian

Curewell Capital Closes Oversubscribed Inaugural Fund at $535 Million

Curewell Capital announced the closing of Curewell Capital I, LP (together with its related vehicles, the “Fund”) at its hard cap of $535 million. The inaugural Fund was raised in a single closing and completed less than five months after launch.

The company secured commitments from a diverse group of global institutional investors, comprised of leading endowments, foundations, pensions, insurance companies, consultants, family offices, and industry executives.

Founder Michael Dal Bello