The exciting VC/PE acquisition of HistoSonics and Alcon’s $1.5B deal for STAAR Surgical headline a blockbuster week in MedTech, which included M&As, IPOS and funding rounds. It shows not only that the market is willing to support new technologies that fill a critical need, but also that established companies are making strategic bets to stay ahead. Read the full roundup in this week’s GS MedTech Funding Tracker.

HistoSonics has majority stake acquired for $2.25bn by investor syndicate

HistoSonics announced a management-led majority stake acquisition by a syndicate of private and public investors. The deal for the Minneapolis-based histotripsy therapy platform developer is valued at approximately $2.25 billion.

Тhe transaction positions it to accelerate growth for its Edison system. The company was subject to acquisition speculation earlier this year, with Medtronic, GE HealthCare and Johnson & Johnson rumored to be circling.

President and CEO Mike Blue

Last week’s tracker: InspireMD, Ultromics, and more

Alcon strikes $1.5bn deal to acquire ailing rival STAAR Surgical

Alcon has agreed to acquire struggling rival eyecare specialist STAAR Surgical in an equity deal valued at around $1.5bn. The deal equates to the buyout of STAAR’s outstanding stock at $28 per share and will avail Alcon of STAAR’s EVO Implantable Collamer Lens (ICL) portfolio.

Alcon said the addition of STAAR’s EVO ICL will complement its laser vision correction business and positively impact profit margins from year two post-transaction. The deal is expected to close within six to 12 months, pending customary closing conditions.

CEO David Endicott

Heartflow raises $316.7 million in US IPO as medtech listings attempt comeback

The Mountain View, California-based company sold 16.67 million shares at $19 each, compared with a targeted range of $17 to $18 apiece. It upsized its offering and raised the proposed range earlier this week reflecting strong demand.

The IPO valued the company at $1.54 billion. U.S. IPOs have picked up pace in a much-awaited recovery, as solid tech earnings and progress on trade deals have helped restore investor confidence.

President and CEO John Farquhar

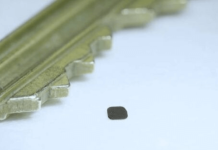

Apreo Health raises $130m to fund emphysema implant pivotal trial

The Series B round was co-led by new investors Bain Capital Life Sciences and Norwest and brings Apreo’s total funds to around $153m. Returning investors Lightstone Ventures and Santé Ventures also participated.

The funds will primarily support the initiation of the BREATHE-3 pivotal trial to evaluate its BREATHE Airway Scaffold implant. The company also plans to use the financing towards regulatory activities associated with the pivotal trial and early commercialisation efforts to demonstrate BREATHE’s market potential.

CEO Karun Naga

Fractyl prices $20m offering

The company priced an underwritten public offering worth proceeds of $20 million. The offering includes more than 19 million shares of common stock and accompanying Tranche A and Tranche B warrants.

Each share of common stock comes with one Tranche A warrant (two-year term) and one Tranche B warrant (five-year term). The shares come at a price of $1.05, with both types of warrants featuring the same fixed price.

Co-Founder and CEO Dr. Harith Rajagopala

CardiacBooster secures $10.8m for ventricular assist device

A consortium led by CardiacBooster, in partnership with Fire1 and Integer, received $10.8 million (€9.3 million in funding) recently. The funding, from Ireland’s Disruptive Technologies Innovation Fund (DTIF), supports the development of CardiacBooster’s unique mechanical cardiac support technology into a comprehensive medical device platform for treating cardiogenic shock.

This consortium aims to bring significant innovation to an indication with high mortality rates. The companies hope to improve health outcomes and prevent loss of life with new therapeutic tools.

CEO Florian Ludwig