Eventum Orthopaedics, manufacturers of a device that it says could ‘revolutionise’ knee replacement surgery has raised a further 3.8 million GBP from NPIF II – Mercia Equity Finance, which is managed by Mercia Ventures as part of the Northern Powerhouse Investment Fund II (NPIF II), Mercia’s EIS funds and private investors including leading surgeons.

The funding will enable the company to build stocks of its product following its launch in the UK, US and New Zealand and to help it develop two new devices.

Related: Laplace Interventional raises $22m for tricuspid valve tech

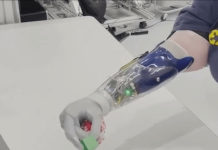

Eventum’s QuadSense device helps surgeons to precisely cut and place the kneecap in total knee replacements. The company says that over 2 million patients a year have knee replacements globally, yet around 20% are not fully satisfied with the outcome. Eventum believes the key to improving success rates is the position of the kneecap, which plays a crucial role in the knee’s function.

QuadSense, which is the only device that provides surgeons with real-time data on the position of the kneecap, has already gained regulatory approvals in the UK and US and been used in over 300 procedures. The company has now appointed distributors in both countries and in a number of other key international markets, and it is developing similar devices for shoulder and hip operations.

Eventum, which employs a team of ten at its headquarters in Ilkley, Yorkshire, was founded in 2020 by former medical executives John Naybour and Paul Atherton. The latest funding round is the third led by Mercia Ventures and NPIF and brings the total raised by the company to over 7 million GBP.

John Naybour, founder and CEO said: “Total knee replacement is a common operation, yet two out of ten patients are not happy with the results and one in ten is very dissatisfied. Our mission is to improve success rates by providing data to help surgeons to make better clinical decisions. The device has been well received by the orthopaedic profession and we are excited to be rolling it out internationally.”

Rob Hornby of Mercia Ventures added: “Eventum’s product will not only improve outcomes for patients but also reduce the cost of treating dissatisfied patients which is estimated at £5,000 and £6,000 for each case. Having supported the company from an early stage, we are pleased to see it achieve this important milestone with the launch of its first product. We look forward to working with the team as they grow sales and develop new products to improve the success of other common operations.”

Lizzy Upton, senior manager at the British Business Bank said: “West Yorkshire is known for its expertise in developing implants, such as those used in orthopaedics, so it’s great to see the Northern Powerhouse Investment Fund II being used to support growth in this sector. Eventum is a perfect example of how Yorkshire-based businesses can harness the power of NPIF II to expand, creating jobs in the region and contributing to the regional economy.”

The 660 million GBP Northern Powerhouse Investment Fund II (NPIFII) covers the entire North of England and provides loans from 25,000 GBP to 2 million GBP and equity investment up to 5 million GBP to help a range of small and medium sized businesses to start up, scale up or stay ahead.

The purpose of the Northern Powerhouse Investment Fund II is to drive sustainable economic growth by supporting innovation and creating local opportunity for new and growing businesses across the North of England. The Northern Powerhouse Investment Fund II will increase the supply and diversity of early-stage finance for the North’s smaller businesses, providing funds to firms that might otherwise not receive investment and help to break down barriers in access to finance.