Total funding for the company has reached $550bn, but there’s still a way to go before reaching the market.

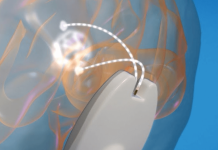

Elon Musk’s brain implant company Neuralink has had its largest capital financing round yet, raising $280m in a bid led by Peter Thiel’s Founders Fund. The news follows the company’s announcement in May that it received US Food and Drug Administration (FDA) approval for human testing of its flagship product.

Total funding for the company has now crossed the half-billion mark, with much of the capital coming from Theil’s fund. Despite this, the company’s long-term goals remain unclear.

Musk has a history of vague, grandiose claims about his products, and Neuralink is no exception. He has been quoted as saying he “created [Neuralink] specifically to address the artificial intelligence symbiosis problem, which I think is an existential threat.”

Though the company is not yet recruiting for clinical trials, its patient registry application is open to individuals with a variety of serious conditions including paraplegia, vision loss and the inability to speak.

According to its website, Neuralink’s aim is to allow individuals to control computers with their minds and in future restore vision, speech and motor function.

While FDA approval is a large step forward in this regard, there are still many hurdles to jump before the product has a chance of getting to market. Last year an investigation by Reuters reported that Neuralink had killed around 1,500 animals through rushed testing, leading to an ongoing investigation by the US Department of Agriculture (USDA).

The company may also find that its rapid trial approval is not matched by a quick product launch. One of their key competitors, Blackrock Neurotech, has been conducting human trials for over a decade and is still yet to release its product to a general audience.

The early signs are positive for Musk’s project, with funding flowing freely and an FDA green light but the complicated technology is likely to take years to reach maturity.

Our signals coverage is powered by GlobalData’s Disruptor data, which tracks all major deals, patents, company filings, hiring patterns and social media buzz across our sectors. These signals help us to uncover key innovation areas in the sector and the themes that drive them. They tell us about the topics on the minds of business leaders and investors and indicate where leading companies are focusing their investment, deal-making and R&D efforts.