Microbot Medical said investors agreed to exercise outstanding preferred investment options that could generate up to $92.2 million in gross proceeds.

The company expects about $25.2 million from the first closing on Sept. 16, and $4 million from a second closing by Oct. 15. The remaining $63 million could come from new short-term series J preferred investment options if they are exercised in full. The company said there is no assurance those options will be exercised.

Related: SafeHeal raises €10M Series C extension for colorectal surgery device

Investors will exercise options to purchase 12,064,627 shares of common stock at prices ranging from $1.50 to $2.13 per share in the first closing. In exchange, Microbot will issue new unregistered short-term series J options for the same number of shares. In the second closing, a holder will exercise options to purchase 1,924,488 shares at $2.10 per share, also receiving new series J options. The new options have a $4.50 exercise price, become exercisable six months after issuance, and expire two years later.

As of Sept. 15, Microbot had 52,794,762 shares of common stock outstanding.

The company intends to use the proceeds to support development, commercialization, and regulatory work for its Liberty Robotic System, pursue potential acquisitions, expand applications of its intellectual property, and for working capital and general corporate purposes.

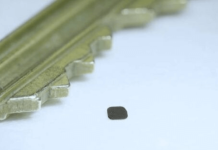

Microbot’s stock sale follows the Sept. 8 announcement that its Liberty endovascular surgical robot won FDA 510(k) clearance. Microbot describes Liberty as the world’s first single-use, fully disposable robotic system for endovascular procedures.