WishBone Medical, Inc., a leader in pediatric orthopedic medical devices, announced the procurement of additional growth capital as well as changes to executive leadership, including the appointment of Dr. Mark Figgie as Interim Chief Executive Officer. The latest funding comes from LKCM Headwater Investments (“LKCM Headwater”), the private equity arm of Luther King Capital Management which is an SEC-registered investment adviser with approximately $22.1 billion in assets under management. These strategic changes will fuel the commercialization of WishBone’s existing portfolio while supporting new product development and sustaining its mission to raise surgical standards for children.

“At a time of uncertainty in our capital markets, our team at LKCM Headwater and WishBone’s Board of Directors have worked diligently to secure the means necessary to support the company’s objectives and continue this rewarding mission,” says Michael D. Bornitz of LKCM Headwater and WishBone board member.

“I am honored to take the helm of WishBone Medical and help make a meaningful impact through leadership and innovation—building upon my extensive network within the orthopedic community to produce novel solutions that promote OR efficiency and improve outcomes for our young patients,” adds Dr. Figgie.

With Dr. Figgie serving as interim CEO, WishBone cofounders Nick Deeter and Mary Wetzel are stepping away from their positions as CEO and President and moving into consulting roles to assist in business development, healthcare partnerships, and identification of new technology ventures.

“WishBone constituents may know Dr. Figgie for his advocacy as a foundational board member, investor, and his 40 years of exemplary experience in orthopedics,” says WishBone board member, Manny Losada, CEO & President of Optimal / MedPro Healthcare Solutions. “However, he also has an incredible business acumen grounded in an MBA at NYU and managed a boutique manufacturing firm in Cleveland, OH, while attending medical school. Dr. Figgie will work alongside the seasoned executive management team and surgeons to create leading-edge solutions that kids deserve.”

RELATED: Healthcare fintech PayZen raises $20M, receives $200M credit facility

About LKCM Headwater Investments

LKCM Headwater Investments is a Texas-based private investment firm affiliated with Luther King Capital Management, an SEC-registered investment firm established in 1979 with over $22 billion USD of AUM. LKCM Headwater’s proven investment discipline is centered around a long-term focus of investing in strategically well-positioned companies with opportunities to re-invest cash flows into multiple high return investment opportunities. Further, LKCM and its affiliates have a long history of successfully investing in and growing medical device companies. For more information, visit www.lkcmheadwater.com

About Mark Figgie, MD

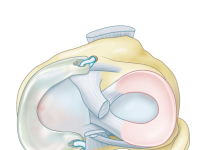

Dr. Mark P. Figgie is Chief Emeritus of the Surgical Arthritis Service at the Hospital for Special Surgery. He is one of the leading experts in joint replacement for inflammatory arthritis and was the inaugural Chair of the Allan Inglis Chair for research for surgery in inflammatory arthritis. His training in engineering and biomechanics has helped him become instrumental in the design of implants for elbows, knees, and hips, including the design of custom implants.

About WishBone Medical

WishBone Medical is a global pediatric orthopedic company, committed to providing highly differentiated pediatric implants, instruments and solutions in single-use, sterile packed procedure kits designed to prevent infection, reduce overall costs for customers and achieve the best outcomes for children around the world who are still growing. Surgeon-led Innovation | Designed for Kids | Engineered for efficiency.

We WORK so They can PLAY.™

For more information, visit www.WishBoneMedical.com or contact Kaitlyn Hughes, Director of Marketing & Communications, at +1-574-306-4006. For investment related inquiries, please email Mike Milligan, Chief Accounting Officer, at MikeMilligan@WishBoneMedical.com.