Spineology raised $25 million to support its OptiMesh patient-specific, expandable spine implant. SV Health Investors led the Series AA round, while 1315 Capital and existing investor RC Capital also participated.

“We are thrilled to welcome SV Health Investors and 1315 Capital. This infusion of capital allows us to provide our offering more rapidly to patients and clinical programs across the country,” said Brian Snider, Spineology CEO. “OptiMesh’s powerful distraction forces and conformance to the endplates provide strength and stability to restore disc height, achieve alignment goals, and promote robust fusion. It is evident that surgeons and patients desire less disruptive options to treat spinal disorders, further accelerating our opportunity.”

Related: NanoHive Medical raises $7M Series C

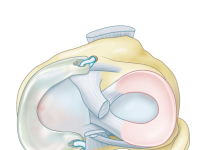

Spineology said OptiMesh represents the only in situ patient-specific, expandable implant on the market. Delivered through the smallest insertion portal in the lumbar interbody market, it dynamically conforms to a patient’s unique endplate morphology. The system expands to one of the largest footprints available, Spineology says.

A single implant can offer utility in multiple lumbar fusion approaches, accommodating the needs of each patient. The minimally invasive approach provides faster post-operative healing and a return to a higher quality of life, too. OptiMesh already has FDA investigational device exemption (IDE) data on-hand and holds a de novo grant for spinal fusion.

“Spineology’s OptiMesh technology is disrupting the industry for the better. Backed with IDE level data, this is an implant category of its own. We look forward to tremendous growth ahead bringing this unique offering to more hospitals and surgery centers in the U.S.,” said Tom Patton, executive chair, Spineology.