Solventum has acquired US-based Acera Surgical in a deal worth up to $850m, positioning the company to progress in the synthetic tissue matrices technology space.

Solventum, which span out from 3M in 2024, will pay $725m in cash up front to acquire Acera, with up to $125m in cash payments predicated on hitting certain future milestones.

Related: GE HealthCare to advance enterprise imaging through Intelerad acquisition

Solventum’s shares opened 1% up at $78.15 on 20 November from a 19 November market close of $77.31. Investor optimism in the deal continued over the weekend, with shares trading at a price of $82.72 at market open on 24 November. The company has a market cap of almost $15bn.

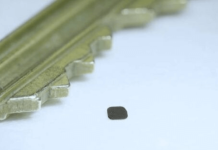

Acera’s portfolio consists of its Restrata line of electrospun fibre matrices in various forms – such as sheet, mesh, and powder – that support wound healing and soft tissue reinforcement by mimicking the human extracellular matrix (ECM) to support tissue regeneration. Applications include diabetic foot ulcers, pressure ulcers, trauma wounds, and surgical incisions.

Solventum anticipates that factors such as its strong market position in advanced wound care, existing clinical relationships, and global footprint will accelerate the adoption of Acera’s Restrata portfolio in the acute care market.

3M rebranded Acelity’s KCI business into 3M Medical Solutions Division following its 2019 acquisition. Charlie Whelan, senior director of consulting for medical devices at GlobalData, noted that the deal included the former KCI and its NPWT business, as well as LifeCell and Systagenix Wound Management.

He said: “Those two companies are actually more akin to what Acera is all about. So, in some ways, they may be leveraging some of this deeper knowledge in their roots.”

GlobalData analysis reveals that the global wound care market is growing at a CAGR of 4.4% and is forecast to reach a valuation of almost $50bn by 2034, up from $32.1bn in 2024.

According to Dr Andrew S Thompson, director of therapy research and analysis in medical devices for GlobalData, Solventum’s rationale behind acquiring Acera is predominantly centred on the company’s Restrata MiniMatrix.

Approved by the US Food and Drug Administration (FDA) in 2023, MiniMatrix is a powder-like fibre matrix material that Thompson notes is backed by a lot of clinical data, particularly in the area of diabetic foot ulcers, indicating its applicability in the area of chronic wounds.

According to Thompson, while Acera is expected to generate around $90m in 2025, the figure is mostly on the basis of the MiniMatrix, which is currently only approved for the US market.

He said: “Solventum’s size and track record make it well-positioned to seek international approval for the device, as well as to expand its reach into more US hospitals.

“Even just expanding market access could see revenue increase to $110m or more, but obviously Solventum is hoping for many multiples of this, leveraging its existing strong placement in the wound dressings and wound care management markets.”

Solventum’s CEO Bryan Hanson highlighted that the acquisition of Acera also represents another step in the company’s three-phased transformation plan. Reiterated during Solventum’s investor day in March 2025, the plan involves enhancing the company’s execution plans and strategic focus on driving revenue growth and optimising its portfolio.

As part of the ongoing strategic refresh, Solventum divested its purification and filtration business unit to Thermo Fisher Scientific in February 2025 in a cash deal worth around $4.1bn.

Hanson added: “Expanding our advanced wound care portfolio into the high-growth synthetic tissue matrices category complements solutions within our existing portfolio and enhances the options our specialised commercial team can provide doctors, nurses, and decision makers within acute care settings.”