SetPoint Medical raised $140 million in private financing, including a second Series C tranche and its Series D round.

The financing includes $25 million in the Series C round’s second tranche, followed by $115 million from the Series D. Elevage Medical Technologies and Ally Bridge Group co-led the financing. In conjunction with the financing, Dr. Josh Makower (Elevage) and Kevin Reilly (Ally Bridge Group) joined the company’s board.

Related: CardiacBooster secures $10.8m for ventricular assist device

Valencia, California–based SetPoint said it plans to use proceeds to support commercialisation efforts for its neuroimmune modulation therapy. The company also plans to use proceeds to advance its pipeline for other autoimmune conditions beyond rheumatoid arthritis (RA).

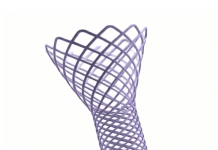

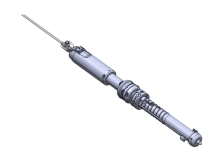

SetPoint Medical designed its implantable, integrated neurostimulation system to deliver electrical stimulation to the vagus nerve once per day. It activates the body’s innate anti-inflammatory and immune-restorative pathways to treat RA.

The first-of-its-kind device treats adults with moderate-to-severe RA not adequately managed by (or failing to tolerate) existing therapies. Those therapies include biological and targeted synthetic disease-modifying anti-rheumatic drugs (DMARDs).

SetPoint Medical won FDA approval for the system last month. Ahead of commercialization, the company also appointed two new executives. Erik Styacich, former VP of Sales for Valencia Technologies, joins as VP of sales. Spencer Bailey joins as VP of market access & reimbursement. The company expects to introduce the SetPoint system in certain U.S. cities through a targeted launch this year. It anticipates a wider launch across the country in early 2026.

“We are pleased to share these strategic milestones underpinning our commitment to a successful and seamless market launch for the SetPoint System in select U.S. markets this year, with broader national expansion in 2026,” added Murthy V. Simhambhatla, Ph.D., CEO of SetPoint Medical. “We are thrilled to welcome an outstanding group of new investors to our exceptional syndicate.”

New investors Northwell Health, SPRIG Equity and an undisclosed strategic investor also participated in the Series D financing. Returning investors Norwest, New Enterprise Associates (NEA), Viking Global Investors, Action Potential Venture Capital, Abbott, Boston Scientific, Euclidean Capital, Richard King Mellon Foundation, Morgenthaler Ventures, ShangBay Capital, Ascendum Capital, Catalio Capital Management, Gilmartin Capital and Midas Capital took part, too.