Reprieve Cardiovascular closed an oversubscribed Series B financing totaling $61 million.

Deerfield Management led the funding round. Arboretum Ventures, Lightstone Ventures, Sante Ventures, Genesis Capital, Rex Health Ventures and Cadence Capital joined with an undisclosed strategic investor. The financing combined equity investment with a debt facility to support the company’s growth.

The company plans to use proceeds to support the execution of its pivotal clinical trial and to support commercial readiness activities. Its FASTR II trial already enrolled its first patient ahead of evaluating the Reprieve system.

Related: Conformal Medical closes $32m Series D extension

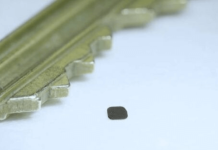

Milford, Massachusetts-based Reprieve Cardiovascular designed the system to personalize decongestion management. It safely, quickly and thoroughly removes excess fluid to improve patient outcomes and prevents hospital readmissions. Through the precise administration of diuretics, the system aims to remove fluid and sodium. It also replenishes the body with saline to support optimal kidney function.

The Reprieve system combines real-time physiological monitoring with automated recommendations to escalate or end therapy. It allows physicians to tailor treatment to each patient’s specific needs during therapy. This streamlines patient care and reduces workload for clinicians treating heart failure patients.

FASTR II follows the company’s FASTR randomized pilot study last year. That study met both primary efficacy and safety endpoints. Now, FASTR II evaluates Reprieve’s efficacy compared to optimal diuretic therapy in patients hospitalized with acute decompensated heart failure (ADHF). It aims to see if the system can decongest patients more effectively than today’s standard of care.

Reprieve Cardiovascular expects to enroll up to 400 patients across the U.S. and Europe. It plans to use findings to support a future FDA premarket approval (PMA) submission.

“We are pleased to close this latest financing round, which reflects the strong continued support of our existing investors, as well as the addition of new investors, who each bring unique strategic insights to Reprieve,” said Mark Pacyna, Chief Executive Officer of Reprieve Cardiovascular. “This capital ensures we are positioned to generate the clinical and economic evidence essential for regulatory approval and commercialization. We believe our personalized approach to decongestion management can enable better outcomes for both patients and healthcare systems around the world.”