Onward Medical announced it launched a capital increase by way of a bockbuild offering through a private placement.

The private placement with institutional investors includes ordinary shares with a nominal value of €0.12 apiece. Eindhoven, The Netherlands-based Onward expects to raise gross proceeds of approximately €50 million ($58.1 million) in the placement.

According to a news release, the company currently plans to use its proceeds, along with its existing cash balance, to fund development initiatives. Those include product development, clinical studies and regulatory activities for the investigational ARC-IM system.

Related: Roclub raises $11.7m to support US teleoperation platform launch

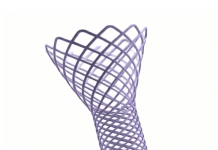

The investigational ARC-IM spinal cord stimulation (SCS) system delivers targeted and personalized spinal cord stimulation. It received FDA investigational device exemption in August. Ongoing studies evaluate the system’s ability to address blood pressure instability after spinal cord injury (SCI).

Onward plans to put 40% of the proceeds toward ARC-IM efforts. An additional 30% would go toward expanding sales and operations to support the commercialization of the ARC-EX system.

ARC-EX SCS therapy delivers targeted, programmed electrical stimulation transcutaneously to the spinal cord. The technology uses electrodes placed on the back of the neck for non-invasive therapy without the need for surgery. It enables increased strength, movement and function in the upper limbs after SCI.

Onward won FDA approval for the system in December 2024. The company made the first commercial sales of ARC-EX in the U.S. in January. Last month, Onward picked up CE mark for the system as well and plans to expand commercial efforts in the U.S. and Europe.

Remaining funds are earmarked for scale quality and administrative activities (20%), working capital and general corporate purposes (5%) and financing costs, including an existing debt obligation (5%). Onward expects the proceeds to deliver a cash runway through at least the end of 2026.