US-based device company Novocuff has raised $26m in an oversubscribed Series A financing round to fund the development of its device aimed at reducing the risk of preterm births.

The company plans to use the funds to finance its device’s clinical development, regulatory efforts, and early-stage commercialisation. The multi-centre US pivotal trial is expected to start in early 2025.

Related: Loci Orthopaedics closes $14M Series A for thumb arthritis implant

The Series A investors included US and European-headquartered investment companies, including Avestria Ventures, AXA IM Alts, Laborie, Laerdal Million Lives Fund, March of Dimes, and RH Capital.

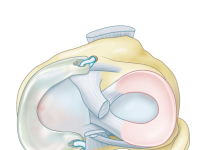

Novocuff’s device is aimed at managing preterm premature rupture of membranes (PPROM) and cervical shortening, both of which can cause preterm birth. Preterm birth is when the baby is delivered before 37 weeks of gestation. Preterm infants are more prone to health concerns and can require intensive care.

PPROM occurs in approximately 1%-4% of all pregnancies, its incidence can be as high as 13.9% in developing countries, as per a 2022 study. Novocuff’s device stabilises and closes the cervix to retain amniotic fluid and sustain cervical length, which can extend pregnancy and prevent preterm births.

The company had previously raised $2m in seed funding and launched two first-in-human clinical studies. Each of the studies investigates the device in PPROM and cervical shortening.

There has been increased interest in women’s health, along with increased investment. In January 2024, Qvin received US Food and Drug Administration (FDA) clearance for a menstrual pad designed with a removable strip to collect blood samples for clinical tests. The Q-Pad is designed as an alternative to traditional intravenous methods of drawing blood for a typical blood test.

Another women’s healthcare company, Gynesonics, raised $42.5m in financing to help further commercialise its uterine fibroid ablation device, in November 2023. The Sonata device uses radiofrequency ablation with intrauterine ultrasound guidance to treat symptomatic uterine fibroids.