Robotics company Medical Microinstruments (MMI) has secured $110m in Series C financing to support the commercial launch of its Symani Surgical System in high-growth markets.

The funding round was led by Fidelity Management & Research. MMI said that the funds represent the largest-ever investment in microsurgery innovation.

Related: Eindhoven-based medtech startup Scinvivo bags €4.7M to improve cancer diagnostics

The robotics company, which was founded in Italy in 2015, will also use the Series C proceeds to invest in trials that produce clinical evidence and allow the expansion of indications.

In addition, MMI will use the funds to expedite its advanced technology capabilities to scale its operational capabilities on a global level.

MMI CEO Mark Toland said: “Against a backdrop of plateauing investments in medical robotics, this support builds on our confidence in a new, less invasive solution for open surgery, a significant market that can benefit from the smallest wristed microinstruments.

“Our Symani Surgical System is uniquely positioned to expand patient access to care by accelerating the number of surgeons able to perform complex, delicate procedures.

“With the support of our investors, we will continue to advance our technology through a growing body of clinical evidence and expanded hospital partnerships.”

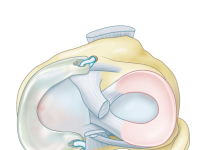

The Symani Surgical System is said to be a first-of-its-kind technology that addresses the scale as well as complexities of microsurgery and super microsurgery. It received the CE mark in 2019.

The robotic system is designed to allow surgeons to replicate the natural movements of the human hand at the microscale.

MMI said that Symani can increase therapy choices for patients requiring soft tissue, and open surgical operations, such as free flap reconstructions, lymphatic surgery, and trauma replantations.

Furthermore, the system improves patients’ quality of life, supports surgeons in operations on patients with fragile anatomy, and allows hospitals to grow their open surgical programmes.

To date, MMI has raised more than $200m in capital. In 2022, the company closed a Series B financing round to boost expansion.