Kardium announced that it raised $104 million in a new financing round to support its Globe pulsed field ablation (PFA) system.

Existing investor Fidelity Management & Research Company led the round. Funds and accounts advised by T. Rowe Price added follow-on participation and new investor Durable Capital Partners joined as well.

Related: Amber Therapeutics secures $100m for mixed urinary incontinence implant

The new financing allows Kardium to complete the PULSAR clinical study of its Globe system. Vancouver, British Columbia-based Kardium wants to use the results to obtain regulatory approvals. Funds could also go toward growing the company’s manufacturing team and capacity, as well as building clinical and commercial support in preparation for a commercial launch for Globe.

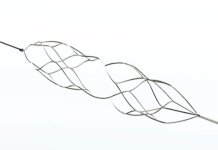

Kardium’s Globe mapping and ablation system features a catheter with a 122-electrode array and advanced software. The platform enables rapid pulmonary vein isolation, high-definition mapping and the ability to ablate anywhere in the atrium. All of these capabilities combine in one single catheter.

Globe catheter sensors provide proprietary Contact maps to identify electrodes in contact with cardiac tissue. This helps to ensure therapy for AFib is effectively delivered.

The company announced the first treated patient in the PULSAR trial in March. It presented positive data supporting the Globe system last month at HRS 2024.

“We are very excited to have the continued support of existing investors, and welcome Durable Capital Partners to this round,” said Kevin Chaplin, CEO of Kardium. “Their enthusiasm and support reflect the incredible success we have achieved with the Globe system and the tremendous potential we have to dramatically improve the treatment of atrial fibrillation for millions of patients worldwide.”