- First fundraising of €2.77 million through the issuance of 9,879,254 shares with warrants

- Acquisition of a 28.96% stake in Sanyou (HK) International Medical Holding Co. limited (“Sanyou Medical”)

- Issuance of 9,879,254 warrants allowing an additional fundraising of €2.77 million, with a commitment from Sanyou Medical to exercise the warrants for a total of €2.50 million

IMPLANET, a medical technology company specializing in vertebral implants, announces the success of the capital increase in cash with maintenance of the shareholders’ preferential subscription right announced on September 28, 2022. This operation raised an amount of € 2,766,191.12 through the issuance of 9,879,254 shares with warrants at a unit price of € 0.28, representing a premium of 60% compared to the closing price of September 27, 2022 (€ 0.175), prior to the setting of the issue price by Implanet’s Board of Directors.

Ludovic Lastennet, IMPLANET’s Chief Executive Officer, stated: “The success of this fundraising, at this valuation, demonstrates the support of our historical shareholders and of our new partner Sanyou Medical, which now holds 28.96% of the Company’s capital. Our capital increase of €2.77 million will be completed before March 31, 2023 by an additional maximum amount of €2.77 million through the exercise of warrants, Sanyou Medical having committed to exercise its warrants for €2.5 million. These funds will allow us to deploy our range of products dedicated to spine surgery on the Chinese market while reinforcing our R&D investments by relying on Sanyou Medical’s know-how and by securing our products at the regulatory level. With these elements and our strategic partnerships, we are confident in Implanet’s ability to reach a new milestone and achieve financial stability in the medium term. Implanet would like to thank its shareholders and Sanyou Medical for their confidence and their participation, which have made this transaction a success.”

The proceeds of the issue, amounting to € 2,766,191.12, will enable the Company to:

- ensure the financing of its cash requirements;

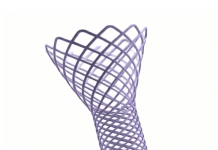

- commercialize its JAZZ® range in China, through a distribution agreement with Sanyou Medical, which will be concluded no later than December 31, 2022. China is the world’s largest potential market in terms of volume for Implanet’s JAZZ® technology, with 15,000 pediatric scoliosis surgeries and 750,000 adult surgeries;

- accelerate innovation by combining Implanet’s expertise with that of Sanyou Medical under a technology partnership agreement to be concluded by December 31, 2022 at the latest, to rapidly develop a new complete range of hybrid fixation systems for Western markets, including the latest advances and innovations in spine surgery (deformity, mini-invasive, robotics, artificial intelligence, etc.);

- capitalize on strategic partnerships to allow Implanet to pass a new milestone and serenely envisage a revenue allowing to reach financial balance in the medium term.

Follow the latest news on Guided Solutions

Main characteristics of the operation

The capital increase was the subject of a global request for 9,879,254 shares with warrants at a unit price of € 0.28, at the rate of 1 share with warrants for 2 existing shares owned, i.e. a total amount requested of € 2,766,191.12, representing 92.76 % of the amount of the initial offer (€ 2,982,221.76). In this context, the Board of Directors has decided not to exercise the extension clause.

The subscriptions were distributed as follows:

– 904,703 shares with warrants on an irreducible basis

– 8,909,127 shares with warrants on a reducible basis

– 65,424 shares with warrants on a free basis

In accordance with its subscription commitment, Sanyou Medical, which held 100,000 Implanet shares, subscribed for 50,000 shares with warrants on an irreducible basis and 8,878,572 shares with warrants on a reducible basis for a total amount of €2,500,000.16 representing a total of 8,928,572 shares with warrants.

The subscription of Sanyou Medical has been fully subscribed.

As a result of the operation, Sanyou Medical now holds 28.96% of the share capital and voting rights of Implanet.

Sanyou Medical has requested a seat on the Board of Directors of the Company as from the completion of its subscription. A general meeting may be convened for this purpose.

After the settlement-delivery, which will take place on October 24, 2022, the share capital of Implanet will consist of 31,180,838 shares with a nominal value of €0.01.

The new shares will be the object of an application for admission to trading on Euronext Growth in Paris on the same day, on the same quotation line as the existing shares (ISIN code FR0013470168 – ticker ALIMP).

The shareholding of a shareholder who held 1% of the company’s capital prior to the capital increase and who did not subscribe to it is henceforth increased to 0.68%.

In accordance with the provisions of articles L.411-2 of the Monetary and Financial Code and, 211-2 and 212-5 of the general regulations of the Autorité des Marchés Financiers (AMF), the present issue has not given rise to a Prospectus approved by the AMF, the latter representing a total offer of between €100,000 and less than €8,000,000, it being specified that no similar offer has been made by the Company during the past twelve months.

The offer was made on the basis of the 11th and 15th resolutions adopted by the Combined General Meeting of Shareholders of June 9, 2022 and the Board of Directors of Implanet of September 27, 2022 having decided on the principle of the capital increase with preferential subscription rights and its implementation.

A notice to shareholders relating to the operation was published on September 30, 2022 in the Bulletin des Annonces Légales et Obligatoires (BALO).

Main characteristics of warrants attached to the new shares

The warrants will be detached from the new shares as soon as the shares with warrants are issued and will be the subject of an application for admission to trading on Euronext Growth in Paris. Their listing is scheduled for October 24, 2022 until March 31, 2023, under ISIN code FR001400COS8.

Eight (8) warrants give the right to subscribe for seven (7) new shares of the company, at an exercise price of €0.32 per share, i.e. a premium of 82.9% compared to the reference price of €0.175, representative of the closing price on September 27, 2022.

The holders of the warrants will be able to exercise them and thus obtain Implanet shares from October 24, 2022 until March 31, 2023 inclusive. Any warrants that have not been exercised by midnight on March 31, 2023 at the latest will automatically lapse and become worthless.

The exercise of all the issued warrants will thus give rise to the creation of 8,644,342 new shares, representing 27.72% of the Company’s share capital after the issue, i.e. a maximum nominal amount of capital increase of € 86,443.42, together with an issue premium of € 2,679,746.02, i.e. a total amount of € 2,766,189.44.

In order to exercise their warrants, holders must make a request to the intermediary with whom their shares are registered.

Sanyou Medical has informed the Company of its irrevocable intention to exercise a maximum amount of € 2,499,999.04 of the 8,928,572 warrants it holds. In this case, and excluding the exercise of any other warrants or other dilutive instruments, Sanyou Medical would hold 43.19% of the Company.

Resumption of the option to exercise the right to receive shares of the Company

Holders of stock options, business creator share subscription warrants and stock subscription warrants, and holders of bonds redeemable in new shares allocated or issued by the Company, are informed that their right to the allocation of new shares of the Company will resume as from the day following the settlement-delivery of these new shares, i.e. October 25, 2022.

The rights of holders of stock options, of warrants to subscribe for business creator shares and of warrants to subscribe for shares, and of holders of bonds redeemable in new shares allocated or issued by the Company who have not exercised their right to the allocation of shares in the Company before September 29, 2022 (00:00 Paris time), will be preserved in accordance with legal and regulatory provisions.

Risk factors

The main risk factors associated with the issue are listed below:

– the volatility and liquidity of the Company’s shares could fluctuate significantly;

– no market for the warrants;

– the market price of the company’s shares may never reach the exercise price of the warrants;

– risk of dilution.

The Company draws attention to the other risk factors relating to the Company and its business set out in Chapter 4 “Risk Factors” of the Company’s 2017 Registration Document filed with the AMF on April 16, 2018 under number D.18-0337, as well as in the annual financial report for December 31, 2021 available on the Company’s website, in the investors-accounts and financial reports section.

Partners of the operation

| Implanet: | Sanyou Medical: | |

| Financial advisor: Atout Capital – Mélanie Bonanno | Financial advisor: Rochefort & Associés – Guillaume de La Hosseraye and Haofei Wu | |

| Legal advisors: Cabinet Bird & Bird – Emmanuelle Porte – Sylvie Hamel – Céline Sol | Legal advisors: Cabinet Leaf – Charlotte Mantoux – Gregory Louvel Cabinet Change – Nicolas Cuntz |

Upcoming event

- EUROSPINE (European Spine Society) annual congress in Milan, October 19 – 21, 2022

Next financial release

- 2022 Third-Quarter Revenue, October 26, 2022 after market close

About Sanyou Medical

Founded in 2005, Shanghai Sanyou Medical Co, Ltd. is a company dedicated to the R&D, manufacturing and sales of innovative and independent orthopedic products. The main products of Shanghai Sanyou are spinal and trauma implants. Shanghai Sanyou is one of the few companies with the ability to make original innovations based on clinical requirements in the field of spinal implants in China.

The Company has established a complete product development system with world-class R&D equipment and project management systems to ensure that its products are advanced, effective and reliable. By the end of 2021, the company had 27 registration certificates for Class III medical devices and 395 patents registered including 61 in inventions, 214 in utility models, 116 in designs and 4 in software copyrights.

About IMPLANET

Founded in 2007, IMPLANET is a medical technology company that manufactures high-quality implants for orthopedic surgery. Its activity revolves around a comprehensive innovative solution for improving the treatment of spinal pathologies (JAZZ®) complemented by the product range offered by Orthopaedic & Spine Development (OSD), acquired in May 2021 (thoraco-lumbar screws, cages and cervical plates). Implanet’s tried-and-tested orthopedic platform is based on the traceability of its products. Protected by four families of international patents, JAZZ® has obtained 510(k) regulatory clearance from the Food and Drug Administration (FDA) in the United States, the CE mark in Europe and ANVISA approval in Brazil. IMPLANET employs 39 staff and recorded a consolidated revenue of €6.1 million in 2021. Based near Bordeaux in France, IMPLANET opened a US subsidiary in Boston in 2013. IMPLANET is listed on the Euronext Growth market in Paris. For further information, please visit www.Implanet.com.