HistoSonics announced that it closed an oversubscribed $250 million financing to support the expansion of its histotripsy platform.

Minneapolis-based HistoSonics’ new ownership group — a syndicate of private and public investors that acquired a majority stake in the company for $2.25 billion in August — led the financing, along with additional investors Thiel Bio and Founders Fund, among others.

Related: Smartlens secures $5.2m to advance FDA process and prepare for miLens launch

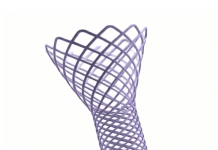

HistoSonics said the financing goes toward its ongoing commercial expansion for the Edison histotripsy system into new markets. The Edison platform uses focused ultrasound energy — delivered via a robotic arm — to provide histotripsy for the noninvasive destruction of tumors. Edison mechanically destroys and liquifies targeted tissue and tumors without the invasiveness or toxicity of traditional procedures. The platform received its first FDA de novo authorization in the U.S. in 2023. It’s the first and only histotripsy platform cleared for clinical use globally.

The company also plans to use funds to accelerate new clinical indications throughout the body and strengthen operational capacity for further growth. HistoSonics aims to expand beyond its initial focus on liver tumors to kidney, pancreas nad prostate indications. It hopes to make histotripsy a treatment option across a wide range of clinical applications throughout the body to treat both benign and malignant conditions.

“This funding, which was a shared priority of our new ownership group, enables us to accelerate key projects designed to expand global access to our platform and advance our therapy across an unprecedented number of new clinical applications and for the patients who need it most”, said Mike Blue, HistoSonics chair and CEO.