As we wrap up the year, big moves this week in MedTech span public markets, venture capital, and early-stage innovation, with fresh funding flowing into diagnostics, surgical tools, reproductive health, and AI-powered care. Read the full updates below.

Medline closed upsized IPO

The offering included more than 248.4 million shares of its Class A common stock priced at $29 apiece. Underwriters also exercised in full their option to purchase up to an additional 32.4 million shares of common stock at the same price.

Altogether, the sale of more than 280 million shares at $29 per share would total more than $8.1 billion.

CEO Jim Boyle

Last week’s tracker: Saluda, WELLSTAR & more

Olympus launched second VC fund with $150M commitment

The company committed $150M to a new venture capital fund, aiming to deploy the capital to promising MedTech startups in the gastrointestinal, urology, and respiratory sectors.

Olympus Innovation Ventures’ Fund II is being established by OIV, a wholly owned subsidiary of Olympus Corporation of the Americas. The fund aims to generate a pipeline of M&A opportunities, partnerships, and valuable market insights.

CEO Robert White

Ultromics secured strategic investment from the American Heart Association

The company announced an investment from the American Heart Association’s Go Red for Women Venture Fund, a fund within American Heart Association Ventures.

The funding accelerates its mission to make early identification of heart failure a standard part of cardiac care, expanding access to its FDA-cleared AI platform already used in leading U.S. hospitals and reimbursed across public and private payers.

Founder and CEO Ross Upton

Ferronova raised $6M in funding

The round was led by Uniseed, South Australian Venture Capital Fund, Artesian Venture Partners and Renew Pharmaceuticals, bringing the total amount to $17.5M.

The company intends to use the funds to expand operations and its development efforts.

CEO Stewart Bartlett

RedDrop Dx announced oversubscribed $5M series seed round

The funding will support the company as it expands manufacturing capacity, accelerates commercial partnerships, and advances development of its platform for decentralized clinical trials, telehealth diagnostics, and population-scale health programs.

The round was led by Innosphere Ventures and Stout Street Capital, with participation from Breakthrough Venture Capital and several strategic angel investors.

CEO Dirk van den Boom

Amferia raised €3.5M investment round

The new funding – led by both existing shareholders and several new investors prominent in global wound care – will accelerate clinical development in human health, scale the company’s growing animal-health business.

The funds also will be used to support commercialization of new products based on its proprietary antimicrobial peptide hydrogel platform.

Co-Founder and CEO Anand Rajasekharan

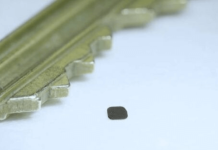

IVFmicro secured £3.5M in pre-seed funding

The new capital will support the next stage of testing, including verification and validation studies that pave the way for trials on human embryos in fertility clinics.

The round was led by Northern Gritstone and joined by the Innovate UK Investor Partnerships Programme.

CEO Virginia Pensabene

PhosPrint secured €500,000 in seed funding

The round was led by Corallia Ventures TT, with the participation of angel investor Dr. Lars Rasmussen.

The investment will support the first-in-human clinical trial of the company’s InvivoLPrint-U, the world’s first bioprinter capable of reconstructing bladder tissue directly inside the patient’s body during surgery.

CEO Ioanna Zergioti

Nurse Capital invested in RoddyMedical

Nurse Capital announced a significant investment from its Fund I in RoddyMedical, a medical device innovator focused on developing products that enhance patient safety and improve staff effectiveness in clinical settings.

The startup is now raising $5 million in Series A funding to expand its manufacturing capacity and market penetration.

CEO Lindsey Roddy