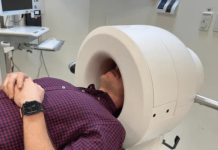

We had a more quiet funding week, part of the expected summer downturn in investment activities. The biggest highlight was GT Medical, which closed funding to help them bring their innovative brain tumour treatment to more patients within the US.

GT Medical closed an oversubscribed $53m Series D equity financing round

The final close comprised an additional $16 million from new investors including FemHealth Ventures, Warren Point Capital and an undisclosed strategic investor. All existing investors also increased commitments, adding to a $37 million first close earlier this year. Evidity Health Capital, Accelmed Partners, MVM Partners, Gilde Healthcare and Medtech Venture Partners led that earlier close.

GT Medical plans to use the funds to drive the expansion of U.S. commercial activities for its GammaTile brain tumour treatment.

CEO Per Langoe

Median Technologies secures up to €37.5m financing from European Investment Bank

The company entered into an agreement with the European Investment Bank for a new financing facility, which could provide up to €37.5 million. The arrangement permits the drawing of funds in three tranches, €19m for Tranche A, €8.5m for Tranche B, and €10m for Tranche C.

These prerequisites include the issuance and registration of EIB warrants, a share capital increase amounting to at least €16m, and the repayment of a tranche from a previous EIB loan that has been extended to October 2025.

CEO and founder Fredrik Brag

Comphya raises CHF 7.5 million for neurostim to treat ED

The Series A close follows the appointment of Pim van Wesel as CEO in May. Comphya, founded in 2017 as an EPFL spinoff, is planning a Series B round to finance its pivotal U.S. trial. The company closed its first tranche of a Series A1 funding round in 2024.

CEO Pim van Wesel

TriAgenics closes $3m Series B-1 financing to support regulatory process for third molar prevention technology

The round was approved by shareholders and completed in partnership with Asclepius Ventures, a private investment firm focused on breakthrough healthcare technologies.

The proceeds will support TriAgenics’ regulatory and clinical strategy, including a planned De Novo classification request with the FDA for its flagship technology, the Zero3 TBA device.

CEO David Thrower