Fractyl Health announced new data supporting its Revita procedure and priced a new public offering.

The data came from the company’s Germany Real-world Registry. It showed that a single Revita procedure led to durable weight loss and glucose control in people with obesity and advanced type 2 diabetes. The company said it underscores the procedure’s potential as a potent, non-drug alternative for patients struggling with long-term metabolic control.

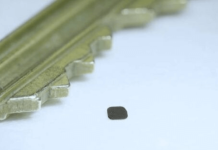

Revita, a diabetes reversal procedure, uses hydrothermal ablation to target the duodenum in conjunction with empagliflozin. Earlier this year, the company announced layoffs as it paused investment in the Revita program to focus on gene therapies.

Related: Alcon strikes $1.5bn deal to acquire ailing rival STAAR Surgical

Fractyl’s German registry, a prospective, post-market clinical follow-up study evaluates Revita in inadequately controlled type 2 diabetes. After a single procedure, the study’s nine participants achieved a median weight loss of 9.6%. Weight decreased from 104 kg to 97 kg at one year, and patients sustained results throughout two years. In parallel, HbA1c reduced by 1.6%, from 9.6% at baseline to 7.2% at one year. Patients sustained this through two years as well (7%).

The company also reports no device- or procedure-related serious adverse events to date. Fractyl’s registry currently has 34 patients enrolled and isn’t enrolling new patients, but the company plans to continue protocol-defined follow-up. It also has an ongoing FDA investigational device exemption (IDE) study (REMAIN-1) evaluating Revita in post-GLP-1 weight maintenance.

“We now have real-world evidence that a single Revita procedure can deliver durable improvements in both weight and glucose control that last for two years,” said Dr. Harith Rajagopalan, co-founder and CEO of Fractyl Health. “These results reinforce what we saw in earlier clinical studies in people living with obesity and type 2 diabetes. The consistency of these outcomes, across both controlled studies and real-world care, speaks to the potential impact of Revita as a one-time, non-drug solution. With randomized data from our pivotal REMAIN-1 study expected in the third quarter of this year, we are moving closer to offering a new option for long-term weight maintenance after GLP-1 therapy.”

In addition to the positive Revita results, the company priced an underwritten public offering worth proceeds of $20 million.

The offering includes more than 19 million shares of common stock and accompanying Tranche A and Tranche B warrants. Each share of common stock comes with one Tranche A warrant (two-year term) and one Tranche B warrant (five-year term). The shares come at a price of $1.05, with both types of warrants featuring the same fixed price.

Tranche A warrants are callable at the company’s option following the release of 3-month randomized midpoint clinical data from the ongoing REMAIN-1 study.

Fractyl also granted underwriters a 30-day option to purchase up to an additional 2,857,142 shares of common stock and warrants. It priced the additional shares and warrants at the existing public offering price.

The company expects to close the offering on or about Aug. 7. It plans to use proceeds to support its Revita and Rejuva pipeline programs and for working capital and other general purposes.