Brightflow SAS completed an oversubscribed Series A financing round worth proceeds of €16.5 million ($18 million). New investors VIVES Partners (Belgium), Majycc Innovation Santé – UI Investissement (France), BNP Paribas Development (France) and international business angels led the financing. Existing investors GO Capital and Karista also participated.

Related: CorFlow bags $48.5m for microvascular obstruction detection device

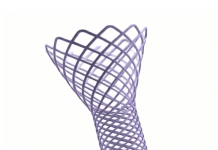

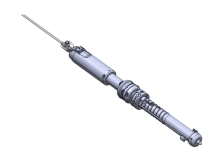

Paris-based Brightflow plans to use funds to support its major strategic initiatives through early 2026. That includes the completion of product development and the first compassionate implants of the company’s technology. Brightflow develops a fully percutaneous long-term right ventricular (RV) mechanical circulatory support system.

The technology aims to treat end-stage heart failure in patients with severe RV dysfunction. The implantable system was designed to support RV failure without the need for open-heart surgery.

This latest development at Brightflow follows last month’s formal appointment of Sophie Humbert as CEO. Humbert previously served as COO at France-based Limflow, a chronic limb-threatening ischemia (CLTI) treatment maker. At the time of her appointment, she said on LinkedIn that Brightflow’s implantable cardiac pump :has the potential to revolutionize the healthcare industry.”

“This financing is testament to the strength of our technology and to our promise to create the first long-term blood pump that can be delivered safely and effectively without open-heart surgery,” Humbert said in today’s news release.

Added Dr. Pascal Lim, founder and president of Brightflow: “We believe the unique design of our blood pump solution will significantly improve the quality of life of many patients.”