Beta Bionics announced that it successfully closed a Series D funding round, securing $100 million in new equity capital.

Concord, Massachusetts-based Beta Bionics develops its flagship iLet bionic pancreas. The autonomous insulin delivery system streamlines diabetes management and reduces the burden on patients and physicians. iLet received FDA clearance in May.

While Beta Bionics did not list an intended use of proceeds, the Series D funds could go toward commercialization efforts for iLet.

New investors Sands Capital and Omega Funds co-led the Series D, while new investor Marshall Wace also participated. Other participation came from previous investors Soleus Capital, Eventide Asset Management, Farallon Capital, Perceptive Advisors, certain funds managed by RTW Investments, ArrowMark Partners and Pura Vida Investments.

“This significant investment represents a powerful vote of confidence in Beta Bionics’ mission to redefine diabetes management with user-centric technologies,” Beta Bionics CEO Sean Saint said in a news release. “We are deeply grateful to our investors for recognizing the immense potential of our products. We are eager to push the boundaries of what’s possible by expanding access to the iLet Bionic Pancreas nationwide and further develop and test the bi-hormonal bionic pancreas.”

RELATED: Beta Bionics Announces FDA Clearance and Commercialization of the iLet Bionic Pancreas

More about the Beta Bionics iLet

With iLet, users only need to input their weight before the system does the rest. It eliminates the need for healthcare providers to determine complex settings like correction factors, insulin-to-carb ratios or pre-set basal rates. Users can “go bionic” with their diabetes management, requiring no carb counting or insulin correction calculations. iLet determines 100% of the insulin doses throughout the day.

The system uses an adaptive, closed-loop algorithm. It initializes with the user’s body weight and requires no additional insulin dosing parameters. The algorithm removes the need to manually adjust insulin pump therapy settings and variables.

iLet simplifies mealtime use by replacing conventional carb counting with its meal announcement feature. This enables users to estimate the amount of carbs in their meal, categorized as “small,” “medium” or “large.” Over time, the algorithm learns to respond to users’ individual insulin needs.

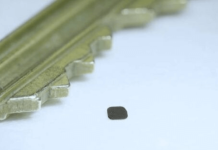

iLet currently pairs with the Dexcom G6 CGM. It also integrates with an infusion set from Convatec, as announced shortly after FDA clearance. Convatec’s inset, an all-in-one infusion set with a built-in insertion device, connects to iLet on one end and the infusion site at the other. It features a soft, indwelling cannula. Convatec’s contact detach comes with a thin, stainless steel needle. Both infusion sets use kink-free infusion tubing to ensure uninterrupted insulin infusion. They also feature a skin-friendly adhesive tape to secure the set firmly at the infusion site.

Former interim CEO and board member Martha Aronson last year told Drug Delivery Business News that the iLet will help those with diabetes reduce the cognitive burden of managing their disease.

The state of play in the insulin pump space

Competition continues to brew in the insulin pump market. Over the past year or two, we’ve seen a bit of an insulin pump boom. Most recently, a new pump — Mobi from Tandem Diabetes Care — entered the market with FDA clearance last month. On top of Tandem’s offerings, both Insulet and Medtronic are making waves in automated insulin delivery.

Insulet’s Omnipod 5 became the first available tubeless, wearable, automated insulin delivery system after the FDA cleared it in January 2022. In April, the company won FDA clearance for the Omnipod GO long-acting insulin delivery device. The new patch pump covers the basal-only insulin population that takes daily injections of long-acting insulin.

Medtronic, meanwhile, made huge strides with the FDA approval of its MiniMed 780G automated insulin delivery system in April. Not long after, the company looked to expand its automated insulin delivery offerings with the planned $738 million acquisition of EOFlow.

Korea-based EOFlow develops the EOPatch, a tubless, wearable and fully disposable insulin delivery device. While EOPatch holds authorization in a number of geographies, it remains unavailable commercially in the U.S. The company submitted the insulin delivery device for U.S. FDA clearance in January.

When Medtronic announced the planned acquisition, investors reacted negatively to the likes of Insulet and Tandem, suggesting a power shift in automated insulin delivery. However, analysts quelled those reservations at the time, calling it “an overreaction.”