Affluent Medical announced today that it entered into a number of agreements with Edwards Lifesciences + related to structural heart products. The deals cover Affluent’s Kalios adjustable mitral annulus and mitral valve technology. Under the terms of the agreements, Affluent receives $16.3 million (€15 million) upfront as a cash payment.

Edwards agreed to pay $5.44 million (€5 million) for an exclusive option to acquire Kephalios, a wholly-owned subsidiary of Affluent. Kephalios supports the Kalios innovative adjustable mitral ring. The option is based on clinical outcomes from a study of the technology. Affluent intends to continue exclusively managing development during the life of the option.

Related: Endoron wins $10m in Series A to advance AAA repair device

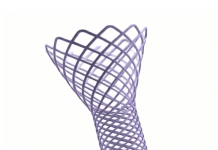

Cardiologists or surgeons can percutaneously — and in a minimally invasive manner — adjust the Kalios mitral valve annuloplasty device. It treats residual and recurrent mitral insufficiency.

The deal includes another $5.44 million payment for the global, non-exclusive license of Affluent’s IP for its biomimetic cardiac mitral valve replacement technology, restricted to open-heart surgery. It could include future royalties on all potentially commercialized products using the licensed patents. The Aix-en-Provence, France-based company retains full patent rights for transcatheter valves, including its Epygon mitral valve.

Edwards, a leader in heart valve technologies, made a final $5.44 million payment toward an equity stake in Affluent.

“We are proud to sign these agreements with the global leader in structural heart innovation,” said Sébastien Ladet, CEO of Affluent Medical. “We look forward to welcoming Edwards as a shareholder in our company. Edwards’ strong global market presence and commercial infrastructure holds the potential for our product Kalios to help doctors and their patients worldwide, while creating a strong partnership for Kalios and surgical mitral valves using our technology. Affluent will continue to develop its transcatheter mitral valve Epygon and its urinary incontinence artificial sphincter Artus.”