Lyra Therapeutics (Nasdaq:LYRA) announced that it closed its previously announced private placement worth $100.5 million.

The company announced last week that, in the private placement, investors had the option in the private placement to purchase either shares of Lyra’s common stock at $4.22 per share or, in lieu thereof, pre-funded warrants to purchase shares of common stock with an exercise price of $0.001 per share at a purchase price of $4.219 per share (equating to $4.22 per share).

Under the agreement, certain investors agreed to purchase an aggregate of more than 18.8 million shares of common stock at the $4.22 per share purchase price. Certain investors also agreed to purchase pre-funded warrants to purchase an aggregate of 5 million shares of common stock at the same price.

“This significant financing is an important indication of investor enthusiasm for Lyra’s product candidates and management team,” Lyra Therapeutics Executive Chair Dr. Harlan W. Waksal said in a news release. “We are now positioned to further build on a track record of success, addressing the unmet need of millions of [chronic rhinosinusitis] patients and the resulting global commercial opportunity.”

New investors, including funds affiliated with Venrock Healthcare Capital Partners, funds managed by Nantahala Capital Management, LLC and Samsara BioCapital, as well as existing investors, such as funds affiliated with Perceptive Advisors, North Bridge Venture Partners and Pura Vida Investments, all participated.

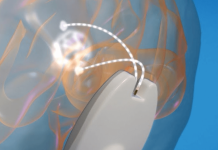

Watertown, Massachusetts-based Lyra Therapeutics — which develops the XTreo platform designed to enable precise, sustained, and local delivery of medications to the ear, nose and throat (ENT) passages and other diseased tissues — said that proceeds, combined with existing cash and expected milestone payments, support the extension of cash runway into mid-2024.

Proceeds will also support Lyra’s ongoing clinical development of its LYR-210 and LYR-220 therapeutics and be used for working capital and general corporate purposes as well.

RELATED: Diligent Robotics scores more than $30M for Moxi healthcare support robot