Carlyle-managed funds have acquired a significant interest in medical device contract manufacturer Resonetics.

Today’s announcement did not include the investment size, but the deal values Nashua, New Hampshire–based Resonetics at roughly $2.25 billion.

Carlyle joins existing investor GTCR as a meaningful shareholder in the company.

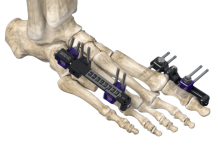

Resonetics focuses on producing highly technical components for medical device applications, providing services from design and development to high-volume manufacturing.

“Our business has advanced significantly over the past four years, expanding on our scale and capabilities and becoming an increasingly valuable partner to our customers, and we look forward to keeping the momentum going,” Resonetics CEO Tom Burns said in a news release.

Steve Wise, a Carlyle managing director and head of global healthcare, said Carlyle’s global network will open up new avenues of organic opportunities for Resonetics — such as international expansion and digitization and increasing scale through acquisitions.

Are you hiring?