Saluda Medical announced that it raised $150 million through an initial public offering on the Australian Securities Exchange (ASX).

Minneapolis-based Saluda raised A$230.8 million through its Australian IPO, beginning trading last week under the “SLD” ticker. The company plans to use the funds to expand its sales team, marketing and commercial support and product development.

Related: Mirai Medical has been awarded €7.2M under the DTIF for PIONEER

Existing securityholders involved in the IPO include Wellington Management, Fidelity Management & Research Company, funds and accounts advised by T. Rowe Price Associates, Inc., TPG Life Sciences Innovations, Redmile Group, LLC, and others.

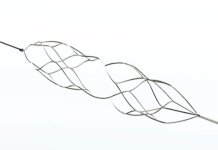

Saluda develops the Evoke neuromodulation system, which uses spinal cord stimulation (SCS) to treat chronic pain. The company raised $100 million to support the technology earlier this year as well.

Evoke senses and measures neural responses to stimulation and automatically adjusts therapy. This helps to achieve and continuously maintain a targeted level of neural activation. That ensures that therapy remains at the patient-specific, prescribed level of neural activation to provide more consistent, effective outcomes.

The Evoke system, which has MRI labeling as well, offers physiologic SCS to treat chronic, intractable pain of the trunk and/or limbs.

Saluda also launched its EVA next-generation sensing technology for its neuromodulation therapy in July.

“This IPO and capital raise mark an important moment for Saluda,” said Barry Regan, president & CEO of Saluda Medical. “With strong clinical evidence, a scalable commercial model, and the dedication of our team, we are now even better positioned to accelerate our mission globally. This funding enables us to expand our U.S. footprint, invest in innovation, and deliver on our commitment to transform patient care worldwide.”