This week’s MedTech lineup spans major financings and meaningful progress across multiple therapeutic areas. Companies developing advanced thrombectomy systems, vascular-access implants, heart-failure therapies, and AI-powered cancer diagnostics all secured new backing. Read more below about the key updates.

Kestra Medical Technologies prices $138M offering

The offering includes 6 million shares of common stock priced at $23 apiece. That brings gross proceeds, before deducting discounts, commissions and other offering expenses, to $138 million.

Kestra also granted underwriters a 30-day option to purchase up to an additional 900,000 common stock shares at the offering price. BofA Securities, Piper Sandler, J.P. Morgan, Goldman Sachs and Wells Fargo Securities serve as bookrunners for the offering.

CEO Brian Webster

Last week’s tracker: Arbiter, Sorcero & more

Xeltis raises $55.1M to advance vascular-access implant aXess toward commercialisation

The company obtained $43.5M of the proceeds from the European Investment Bank under the European Commission’s Invest EU programme, and $11.6M from existing investors, including EQT, and Invest-NL.

Xeltis also plans to use the proceeds to advance its broader implant portfolio.

CEO Eliane Schutte

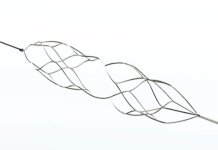

Akura Medical closes $53M Series C

The company plans to use funds to support development activities for its Katana thrombectomy system and the NavIQ quantification software. It also aims to complete enrollment in its QUADRA-PE clinical trial and support regulatory submissions.

Qatar Investment Authority (QIA) led the financing, while current investors also participated. Akura plans to use part of the latest raise to set up a joint venture in Qatar. The latest funding adds to a $35 million Series B raised in 2023.

Chair and CEO Amr Salahieh

VisCardia secures $40M to advance VisONE heart-failure therapy toward PMA approval

The financing will support the execution of the company’s pivotal RECOVER-HF clinical study, and key milestones on the path to PMA. VisCardia expects to achieve the first implant early in 2026.

Multiple leading U.S. institutions have already passed site qualification and are nearing patient enrollment, with a strong pipeline of both national and international institutions to follow.

President and CEO Peter Bauer

MultivisionDx nabs $1.1M to decode cancer ‘fingerprints’ with AI

The startup secured $1.1M in pre-seed funding, led by Antler, with Helsinki University Funds, Kaikarhenni Oy, and a Finnish angel investor, to develop tests, run validations, build partnerships, and pursue public grants.

The company will use the capital to develop its diagnostic tests, complete validation studies, build partnerships with international hospitals and research groups, and unlock additional public funding for scaling.

CEO Michael Wittinger

Syntropic Medical receives investment for light-based depression therapy

The MedTech start-up Syntropic Medical has received new funding from better ventures. The alliance of entrepreneurial business angels from Europe is thus supporting the further development of a digital, non-drug therapy for depression.

The newly raised capital will flow into ongoing clinical studies, preparations for FDA approval in the USA and the development of a telemedicine care model, also with prospects for Germany and Europe.

CEO Mark Caffrey