Galvanize Therapeutics announced it raised $100 million and appointed Doug Godshall as chair and CEO.

Godshall previously served as CEO of HeartWare before its $1 billion acquisition by Medtronic in 2016. Then, he led Shockwave Medical as CEO until its $13.1 billion acquisition by Johnson & Johnson MedTech last year.

He now takes over as CEO of Galvanize as Dr. Jonathan Waldstreicher transitions to the role of president and chief strategy officer. Godshall originally joined the company’s board as its chair in 2021.

Related: ViCentra raises $85m to drive insulin pump’s US market entry

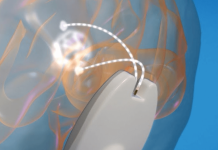

The new leadership move comes as Galvanize looks to advance its Aliya pulsed electric field (PEF) technology for solid tumors and RheOx therapy for chronic bronchitis. Galvanizes’ novel PEF platform, a non-pharmacologic intervention, uses non-thermal, short-duration, highly focused electrical pulses. It destabilizes cellular pathologic processes in the hopes of changing the disease trajectory.

“I began following Galvanize in 2016 and became actively involved when I joined the board as chair in 2021,” Godshall said. “I have grown increasingly enthusiastic about the company’s prospects over the last year as the team continued advancing our portfolio and commencing our initial commercial efforts. Galvanize’s Aliya and RheOx technologies hold great promise in the fields of solid tumor oncology and chronic bronchitis.

“There are millions of patients who are underserved by today’s largely pharmaceutical approaches, and I feel fortunate to be able to join the team as we seek to meaningfully improve the outcomes of those who are suffering with these chronic diseases.”

More on the funding round at Galvanize Therapeutics

Galvanize said that, concurrent with Godshall’s appointment, it closed an oversubscribed $100 million Series C financing.

Sofinnova Partners led the round. A global syndicate of investors, including Norwest Venture Partners, Elevage Medical Technologies, Ally Bridge Group, Perceptive Xontogeny Venture Fund, Janus Henderson Investors and Longaeva also participated. Existing investors Fidelity Management & Research Company, T. Rowe Price, Gilmartin Capital, Intuitive Surgical and the company’s founding investor, Apple Tree Partners, also participated in the round.

As part of the financing, Antoine Papiernik (Sofinnova), Dr. Zack Scott (Norwest) and David Lewis (Gilmartin) join Galvanizes’ board.

The company plans to use proceeds to expand its commercial footprint. It also hopes to advance its clinical and development activities related to Aliya and RheOx.

“We have closely followed Galvanize for years and are impressed by its technology, strong team, and execution,” Papiernik said. “Partnering again with Doug after our Shockwave success, and working with such a powerful syndicate, was an opportunity we couldn’t refuse. We believe Galvanize’s PEF program could significantly improve treatment and benefit patients with serious unmet needs.”