SpectraWave brought in a $50 million Series B financing round led by Johnson & Johnson Innovation – JJDC, Inc. S3 Ventures, Lumira Ventures, SV Health Investors, Deerfield Management, NovaVenture, Heartwork Capital and undisclosed parties joined in, too. The Bedford, Massachusetts-based company plans to use the funds to advance its commercial expansion and product addition efforts. These efforts pertain to the company’s flagship, FDA 510(k)-cleared HyperVue imaging system.

Related: Brightflow raises $18m for implantable cardiac pump

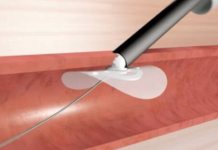

SpectraWave designed its HyperVue system to improve the treatment and outcomes for patients with coronary artery disease (CAD). HyperVue combines next-generation DeepOCT images and near-infrared spectroscopy (NIRS) with workflows optimized for the cath lab. It serves as a central hub for future enhancements to enhance interventionalists’ treatment decision-making and optimization.

The technology optimizes image quality and procedural efficiency with no-flush catheter prep and fast and long pullbacks. These reduce and remove the use of contrast. Additionally, it features a comprehensive AI-driven workflow and image analysis offering.

“The reception to the product during our initial U.S. launch has been fantastic, and this financing, supported by leading medtech investors, will support our commercial expansion to bring HyperVue to more patients,” said Eman Namati, CEO of SpectraWave.

Namati said the company also has work underway on a wire-free physiology software add-on. That would allow physicians to rapidly assess pressure drops in the coronaries while using the same HyperVue hardware.

“This is an important step in our journey to enhance the clinical decision-making for these patients and establish an anchor point for future innovation in the cath lab,” Namati added.