New Zealand healthcare products distributor EBOS Group Ltd said on Thursday it would buy Australian peer LifeHealthcare for A$1.17 billion ($839.6 million), as it looks to expand into the Southeast Asia market.

Under the deal, EBOS will buy LifeHealthcare’s Australian and New Zealand units and 51% of its Asian unit, Transmedic, from funds advised by Pacific Equity Partners and other minority holders.

“The acquisition … represents an important step in EBOS’ medical devices strategy, providing greater exposure to this high-growth sector as well as a measured entry into Southeast Asia,” EBOS Chief Executive John Cullity said in a statement.

The deal is expected to increase EBOS’ earnings per share by a low-double-digit percentage in 2022 on a pro-forma basis, the New Zealand-based firm said.

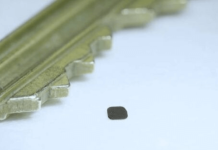

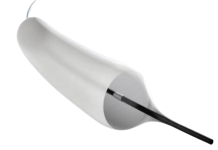

LifeHealthcare, one of the largest independent distributors of third-party medical devices and in-house manufactured allograft material in Australia, New Zealand and South East Asia, was bought by Pacific Equity Partners in 2018.

EBOS said it would undertake a retail offering to raise up to A$100 million, a share placement to raise A$642 million and a loan of A$540 million to fund the deal.

The company also said its net profit after tax (NPAT) grew 14% in the four months to October and that it expected to declare an annual dividend representing 60% to 80% of its NPAT.

($1 = 1.3935 Australian dollars)

Are you hiring?