HistoSonics announced a management-led majority stake acquisition by a syndicate of private and public investors.

The deal for the Minneapolis-based histotripsy therapy platform developer is valued at approximately $2.25 billion. It said in a news release that the transaction positions it to accelerate growth for its Edison system. The company was subject to acquisition speculation earlier this year, with Medtronic, GE HealthCare and Johnson & Johnson rumored to be circling.

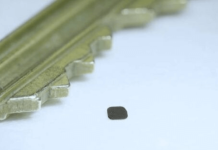

HistoSonics’ Edison platform uses focused ultrasound energy — delivered via a robotic arm — to provide histotripsy for the noninvasive destruction of tumors. Edison mechanically destroys and liquifies targeted tissue and tumors without the invasiveness or toxicity of traditional procedures.

Related: Alcon strikes $1.5bn deal to acquire ailing rival STAAR Surgical

President and CEO Mike Blue will continue to lead HistoSonics along with his executive team. He also intends to take on the role of chair of the board upon the closing of the deal.

“Our relentless focus as a company has been speed, scale, and the urgency to offer patients a better option than any they have today,” said Blue. “This new group of partners backs category-defining companies that transform entire industries. Their support gives us the firepower to accelerate our momentum, expand into new clinical indications, and reach even more patients around the world who urgently need our breakthrough therapy.”

Investors in the syndicate included K5 Global, Bezos Expeditions and Wellington Management. Additional participants include top-tier global investment firms, including Alpha JWC Ventures, alongside existing investors Alpha Wave Ventures, Venture Investors Health Fund, Lumira Ventures, Hatteras Venture Partners, Early Stage Partners, Amzak Health, HealthQuest Capital, Yonjin Venture, the State of Wisconsin Investment Board, the State of Michigan Retirement System, Johnson & Johnson through its corporate venture capital organization, Johnson & Johnson – JJDC, Inc. (JJDC) and more.

The investors bought into the company’s Edison system, which already has FDA clearance for treating liver tumors. It hopes to expand to kidney, pancreas, and prostate indications. HistoSonics has a long-term vision of histotripsy being used across a wide range of clinical applications throughout the body, treating both benign and malignant conditions.

To date, the company reports more than 2,000 patients treated with Edison at over 50 U.S. medical centers. HistoSonics plans to expand with another 50 system installations by year-end.

It also has enrollment underway in clinical trials for liver tumors, kidney tumors and pancreas tumors. The company plans to start other trials in the near future, too.

“What stood out with HistoSonics wasn’t just the technology, it was the speed and clarity with which the team turned a breakthrough into real clinical traction,” said Bryan Baum, co-founder and managing partner, K5 Global. “Hospitals are continuing to order systems, patient demand is surging, and the clinical results speak for themselves. We partnered with HistoSonics because this is one of those rare moments where the science, the execution, and the opportunity all align, and we are here to ensure it reaches every hospital in the world.”