Haemonetics announced that it acquired percutaneous vessel closure device maker Vivasure Medical.

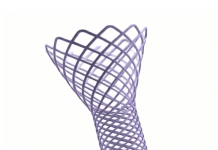

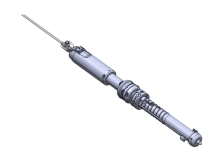

Galway, Ireland-based Vivasure develops the PerQSeal Elite system, which it describes as the first sutureless, fully absorbable synthetic implant for large-bore vessel punctures. Placement occurs from inside the vessel. It makes deployment simpler and more controlled than conventional closure techniques. Additionally, the company says there are no fully bioresorbable devices available for closure following large-bore procedures.

Related: VB Spine completes acquisition of Cestas manufacturing facility from Stryker

The system aims to improve performance in calcium and the treatment of large-hole venous procedures. That includes transcatheter mitral and aortic valve repair and replacement (TMVR/TAVR).

The company submitted the proprietary bioabsorbable patch to the FDA for premarket approval (PMA) in June 2025. The submission followed positive clinical results from the PATCH study, plus strong early feedback from clinical use in Europe. Vivasure won CE mark for the device in April 2025. In addition to its PMA submission, it expanded its indication to cover large-bore venous closure.

Vivasure also touts results from its ELITE study, which demonstrated ease of use with no need for pre-close. PerQSeal Elite delivered 0% major complications at 30-day follow-up and immediate median time to hemostasis.

Haemonetics adds Vivasure’s technology to its portfolio following the sale of its whole blood assets a year ago. The deal includes an upfront cash payment of approximately $116.4 million (€100 million). It also features up to an additional $98.9 million (€85 million) in contingent consideration based on sales growth and other milestones. Haemonetics financed the transaction through available cash on hand.

Commentary from Haemonetics and Vivasure officials

Ken Crowley, VP & GM, Interventional Technologies at Haemonetics, said:

“Acquiring Vivasure expands Haemonetics’ complete range of closure devices with new and clinically differentiated technology to bolster our presence in the large-bore closure market and our impact in fast-growing structural heart and endovascular procedures. With strong clinical performance and safety data, PerQseal Elite positions us for increased leadership in advanced closure, as we leverage our commercial scale and operational synergies to deliver increased value to physicians and hospitals.”

Andrew Glass, Vivasure CEO, said:

“We’re extremely proud of the progress made in advancing closure technology, and grateful to the clinicians, employees, board members, investors and government bodies who supported Vivasure’s mission. Joining Haemonetics provides the global scale and resources to accelerate the availability of PerQseal Elite and bring its clinical benefits to more physicians and patients worldwide.”

The analysts’ take

BTIG analysts Marie Thibault, Sam Eiber and Alexandra Pang say Haemonetics already had a strategic investment in Vivasure. They note that the company publicly discussed the potential of acquiring and its investment included an option to buy.

They reiterate their “Buy” rating for Haemonetics on the back of the deal.

“We think that the technology fits neatly into [Haemonetics’] existing Interventional Technologies portfolio, as it expands the company’s Vascular Closure reach into TAVR, EVAR and other large-bore cases, adding roughly ~$300M to its TAM and leveraging HAE’s existing salesforce call points,” the analysts said.