Fractyl Health has reported positive results for its hydrothermal ablation device Revita, as the company looks to battle the booming pharmaceutical weight loss therapy sector.

The data was collated from a German real-world registry and involved the first 11 patients who completed at least 12 months of follow-up.

The patients, living with obesity and advanced type 2 diabetes (T2D), had a median age of 62 years and body weight of 111kg.

Related: Galvanize concludes enrolment in study of Aliya PEF system for NSCLC

At the 12-month follow-up, the patients’ median weight decreased to 97kg, representing a nearly 13% total body weight loss. Median HbA1c levels, a measure of blood glucose, also increased by 2.4%.

Ten out of the 11 patients, who were taking up to three glucose-lowering agents before the study, reported that the number of medications being taken remained stable or decreased. No procedure-related adverse safety events were observed in the study.

Fractyl stated the year-long data “demonstrates in a real-world setting the potential for a single Revita procedure to be a durable weight maintenance solution.”

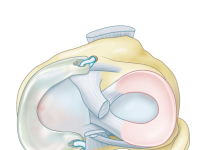

Revita is an outpatient endoscopic procedure that uses hydrothermal ablation to resurface the mucosal lining of the duodenum, the first part of the small intestine just after the stomach. This area of the gastrointestinal tract is responsible for nutrient sensing and subsequent signalling to the brain.

The device, which gained CE marking in 2016, is still only for investigative use in the US. The US Food and Drug Administration (FDA), however, issued a breakthrough device designation to Revita last month for weight maintenance in people with obesity who discontinue GLP-1-based drugs, as well as in insulin-treated T2D.

Fractyl is evaluating the technology in two pivotal studies, REMAIN-1 (NCT06484114) and REVITALIZE-1 (NCT04419779). The first, trialling Revita as weight maintenance for patients with obesity after discontinuation of GLP-1-based drugs, has an anticipated mid-point analysis in Q2 2025.

REVITALIZE-1, evaluating the device in those who are inadequately controlled on any glucose-lowering agent, is currently enrolling in the US and Europe.

The medtech sector, which previously experienced substantial revenue in the form of weight-loss surgeries, is facing competition from popular weight-loss drugs such as Novo Nordisk’s Wegovy (semaglutide) and Eli Lilly’s Zepbound (tirzepatide). The global gastric band and balloon device market is estimated to be worth $80m by 2033, according to GlobalData.

Eli Lilly’s Zepbound (tirzepatide) recorded higher-than-expected sales in Q1 this year, totalling $517m for the US drugmaker. The drug is forecast to generate sales of $27.2bn by 2030, according to GlobalData’s Pharma Intelligence Centre. Wegovy, however, may not reach the same lofty heights, with sales predicted to get to $18.7bn by the same year.

West German Diabetes Center of Excellence director Stephan Martin said: “From what I have seen, I believe patients with obesity and T2D who are looking for an alternative to ongoing medication escalation should consider Revita in conjunction with a diet and exercise program to potentially change the trajectory of their disease. These data show that using Revita in this way could break the pattern of chronic medication and shift the treatment paradigm for obesity and T2D.”