Biocomposites has launched its SYNICEM range of spacers for hip, knee, and shoulder revision surgery in the US.

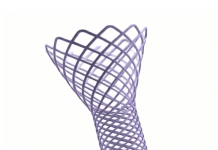

Spacers are used to temporarily fill joint space, preserve soft tissue, and address the risk of infection during revision surgeries. Biocomposites’ SYNICEM spacers come in a variety of sizes and styles to match different patients’ anatomy, with specific left and right geometries available for each knee. To mitigate the risk of soft tissue or bone infection during revision procedures, the spacers come loaded with the antibiotic gentamicin.

Related: Remedy Robotics unveils remotely operable endovascular surgical robot

The launch of the British medtech company’s SYNICEM range in the US follows a UK release in 2023. Biocomposites gained full control of the product range following its buyout of the remaining shares in French engineering firm Synergie Ingénierie Médicale in September 2024.

Biocomposites’ CEO, Michael Harris highlighted that its SYNICEM spacers’ precision-engineered, uniform structure, local antibiotic delivery, and wide size range result in a “faster, simpler, more dependable” alternative to handmade spacers.

Research indicates that hip, knee, and shoulder revision-replacement surgeries in the US are rising. According to experts at Yale Medicine, this rise is largely attributable to the ageing US population.

The rise in revision procedures is also due to implants that have worn down over time, a factor that may be exacerbated by the possibility that initial replacement surgeries were inadequately performed due to a patient’s unique anatomy not being considered.

Johnson & Johnson (J&J) leads the shoulder replacement market in the US with a 12.4% market share. Zimmer Biomet leads in the US hip and knee replacement market, with market share of 19.4% and 29.6%, respectively, as per market models by GlobalData.

However, according to GlobalData analysts, Stryker may be on course to displace Zimmer from its lead position in the US knee reconstruction market.

In Q2 2025, Stryker’s Triathlon total knee replacement system made more revenue than in any other quarter since 2014 – the earliest year tracked by GlobalData. In Q2, the Triathlon made up just over 21% of the total market share in Q2, and Zimmer’s Persona revision knee system just over 22%.

With these figures in mind, GlobalData analysis predict that over the next few quarters, Stryker may be able to take first place in this market if the company can maintain strong sales.