Amid reports that Exo could pull in $100m from investors, the imaging startup has obtained 510(k) clearance from the US Food and Drug Administration (FDA) for two AI-based apps that detect two common lung conditions with its Exo Iris point-of-care ultrasound (POCUS) device.

The newly cleared apps detect pleural effusion and consolidation/atelectasis – conditions caused by the buildup of fluid in the space between the lungs and chest wall and the collapse of lung tissue, respectively. The conditions are recognised as key markers for infections such as pneumonia or tuberculosis and can potentially lead to life-threatening conditions, including re-expansion pulmonary oedema.

Related: FDA OKs Neuspera’s iSNM for urinary urge incontinence

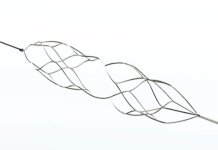

Launched in 2023, Exo Iris is designed for user-friendliness by non-experts. Using AI to aid in ultrasound image acquisition, the device can function without an internet or cloud connection.

Exo AI vice-president Dornoosh Zonoobi commented: “Validated in rigorous clinical studies, these AIs enabled clinicians to detect key lung findings, with sensitivity and specificity in the ‘excellent’ range.”

The latest clearance brings Exo Iris’s FDA-cleared AI apps to 14, adding to a suite of algorithms. These include BladderAI to detect bladder volume and SweepAI for automated AI-based indicators to detect cardiac pathologies such as acute decompensated heart failure, congestive heart failure, volume of stroke and heart rate and assess left ventricular wall hypertrophy.

Last month, sources told Bloomberg that Samsung’s investment arm, Samsung Ventures Investment Corp, may be set to participate in a private fundraising round for Exo. Led by Sands Capital, Bold Capital and Qubit Health Capital, the round is expected to net California-based Exo up to $100m.

According to the report, Exo is also in talks to partner with Samsung Medison, a subsidiary of the South Korean tech giant that makes ultrasound diagnostic devices and markets digital X-ray systems and scanners.

The POCUS market is heating up. A GlobalData market model highlights how the handheld ultrasound market, which includes POCUS devices, is forecast to grow at a CAGR of 4.02% between 2024 and 2034 to a valuation of around $43.3bn.